IRS Form 1099-INT: Examples & Tips for 2023

If you’re an American taxpayer, you must keep track of your income and expenses. One of the ways to do this is to use the 1099-INT form. It’s an important form and it’s useful to know what it is and how to use it.

Who Is Requested to Fill Out Federal Form 1099-INT?

Taxpayers use the 1099-INT form to report interest income received during the tax year. Both individuals and corporations must file this form. It’s important to note that the 1099-INT form does not include any other types of income such as wages, dividends, or capital gains.

The form should be filled out accurately and completely. All the required information should include the taxpayer’s name, address, Social Security number, and financial institution name. The form should also include the interest income received during the year and the taxes withheld from that income.

Difference Between the 1099-NEC and the 1099-INT Forms

- The 1099-NEC form reports non-employee compensation, such as payments made to independent contractors.

- Tax form 1099-INT is used to report any interest income received.

- The IRS 1099-NEC form includes taxes withheld from payments made to independent contractors. The Form 1099-INT does not include any taxes withheld.

FAQ

- What happens if I forget to submit the 1099-INT form?

If you forget to submit the 1099-INT form, the Internal Revenue Service (IRS) may impose penalties and interest on the unpaid taxes. It’s important to make sure that you submit the form on time. - Who must receive the 1099-INT form?

The 1099-INT tax form must be sent to the taxpayer and the IRS. The form should be sent to the taxpayer by January 31st following the tax year. The form should also be sent to the IRS by the same date. - How do I report interest income on my tax return?

Interest income should be reported on Line 8a of Form 1040. You should include the interest income reported on the 1099-INT form and any other payment not reported on the 1099-INT form.

The 1099-INT form is an essential document for U.S. taxpayers. It’s used to report any interest income received during the tax year. The form must be filled out accurately and completely and sent to the taxpayer and the IRS by January 31st following the tax year. Understanding the 1099-INT form and its use is vital for any taxpayer.

Related Forms

-

![image]() 1099-NEC IRS Form 1099-NEC is a document used to report certain types of payments made by a person or business in the United States. This form is used to report nonemployee compensation payments to independent contractors. It is also used to report payments made for services provided to a business by a nonemployee. IRS form 1099-NEC for 2022 must be filled out and submitted to the Internal Revenue Service (IRS) by January 31 of the following year. 1099nec-form.net is a comprehensive website dedicated to... Fill Now

1099-NEC IRS Form 1099-NEC is a document used to report certain types of payments made by a person or business in the United States. This form is used to report nonemployee compensation payments to independent contractors. It is also used to report payments made for services provided to a business by a nonemployee. IRS form 1099-NEC for 2022 must be filled out and submitted to the Internal Revenue Service (IRS) by January 31 of the following year. 1099nec-form.net is a comprehensive website dedicated to... Fill Now -

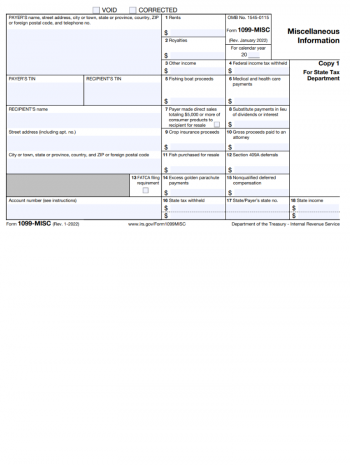

![image]() Form 1099-MISC Let’s face it, taxes can be confusing. One of the most important forms you’ll need to understand as a US taxpayer is the 1099-MISC form. This document is an important part of the annual filing process, and it's essential to understand its purpose and how to fill it out correctly. Who Must File the 1099-MISC Form & How to Fill it Out Correctly The 1099-MISC form is required by the Internal Revenue Service (IRS) for all individuals or businesses who have paid an independent contractor or sole proprietor at least $600 or more in the past year. It's important to note that the 1099-MISC form is not for employees, only independent contractors or sole proprietors. The 1099-MISC form can be filled out either electronically or on paper. It is important to complete the form accurately and legibly since the IRS will use it to check the accuracy of the information on the taxpayer’s income tax return. The information required on the 1099-MISC form includes the following: the recipient’s name, address, Social Security number or taxpayer identification number, the amount of money paid. Difference Between the 1099-NEC and the 1099-MISC Forms The IRS recently introduced the 1099-NEC form, which stands for Nonemployee Compensation. This new form reports payments to nonemployees, such as independent contractors or sole proprietors. The 1099-NEC form is different from the 1099-MISC form in several ways: The 1099-NEC tax form is used to report payments made to nonemployees, while the 1099-MISC reports payments made to nonemployees and employees. The federal 1099-NEC form contains only information about the recipient’s name, address, Social Security number, or Taxpayer Identification Number and the amount of money paid. The 1099-MISC form also contains information about other types of payments, such as rental income, royalties, and medical and health care payments. The tax form 1099-NEC is due to be filed by January 31st, while the 1099-MISC is due by February 28th (or April 1st if filing electronically). FAQ What is the 1099-MISC form?The 1099-MISC form reports payments made to non-employees by U.S. taxpayers. It is an important document used to report earnings to the IRS and is also used to report payments to independent contractors. When should the 1099-MISC form be used?The 1099-MISC form should be used to report payments made to non-employees for services rendered or any other payment, such as interest, rent, royalties, awards, and other forms of income. What information is required on the 1099-MISC form?The 1099-MISC form requires the taxpayer’s name, address, social security number, and information about the payment made including the total amount paid and the type of payment, as well as the recipient’s name, address, and Social Security Number. Fill Now

Form 1099-MISC Let’s face it, taxes can be confusing. One of the most important forms you’ll need to understand as a US taxpayer is the 1099-MISC form. This document is an important part of the annual filing process, and it's essential to understand its purpose and how to fill it out correctly. Who Must File the 1099-MISC Form & How to Fill it Out Correctly The 1099-MISC form is required by the Internal Revenue Service (IRS) for all individuals or businesses who have paid an independent contractor or sole proprietor at least $600 or more in the past year. It's important to note that the 1099-MISC form is not for employees, only independent contractors or sole proprietors. The 1099-MISC form can be filled out either electronically or on paper. It is important to complete the form accurately and legibly since the IRS will use it to check the accuracy of the information on the taxpayer’s income tax return. The information required on the 1099-MISC form includes the following: the recipient’s name, address, Social Security number or taxpayer identification number, the amount of money paid. Difference Between the 1099-NEC and the 1099-MISC Forms The IRS recently introduced the 1099-NEC form, which stands for Nonemployee Compensation. This new form reports payments to nonemployees, such as independent contractors or sole proprietors. The 1099-NEC form is different from the 1099-MISC form in several ways: The 1099-NEC tax form is used to report payments made to nonemployees, while the 1099-MISC reports payments made to nonemployees and employees. The federal 1099-NEC form contains only information about the recipient’s name, address, Social Security number, or Taxpayer Identification Number and the amount of money paid. The 1099-MISC form also contains information about other types of payments, such as rental income, royalties, and medical and health care payments. The tax form 1099-NEC is due to be filed by January 31st, while the 1099-MISC is due by February 28th (or April 1st if filing electronically). FAQ What is the 1099-MISC form?The 1099-MISC form reports payments made to non-employees by U.S. taxpayers. It is an important document used to report earnings to the IRS and is also used to report payments to independent contractors. When should the 1099-MISC form be used?The 1099-MISC form should be used to report payments made to non-employees for services rendered or any other payment, such as interest, rent, royalties, awards, and other forms of income. What information is required on the 1099-MISC form?The 1099-MISC form requires the taxpayer’s name, address, social security number, and information about the payment made including the total amount paid and the type of payment, as well as the recipient’s name, address, and Social Security Number. Fill Now